How to Work Shenzhen’s Supply Chain: A Field Guide for Overseas Founders

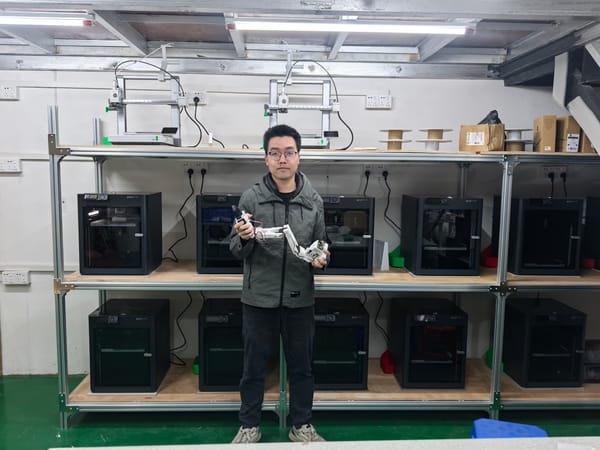

Charley Shen has spent the last 15 years inside the supply chains that power global hardware, starting from components, moving through sourcing, and now helping overseas founders scale full-stack hardware products from Shenzhen.

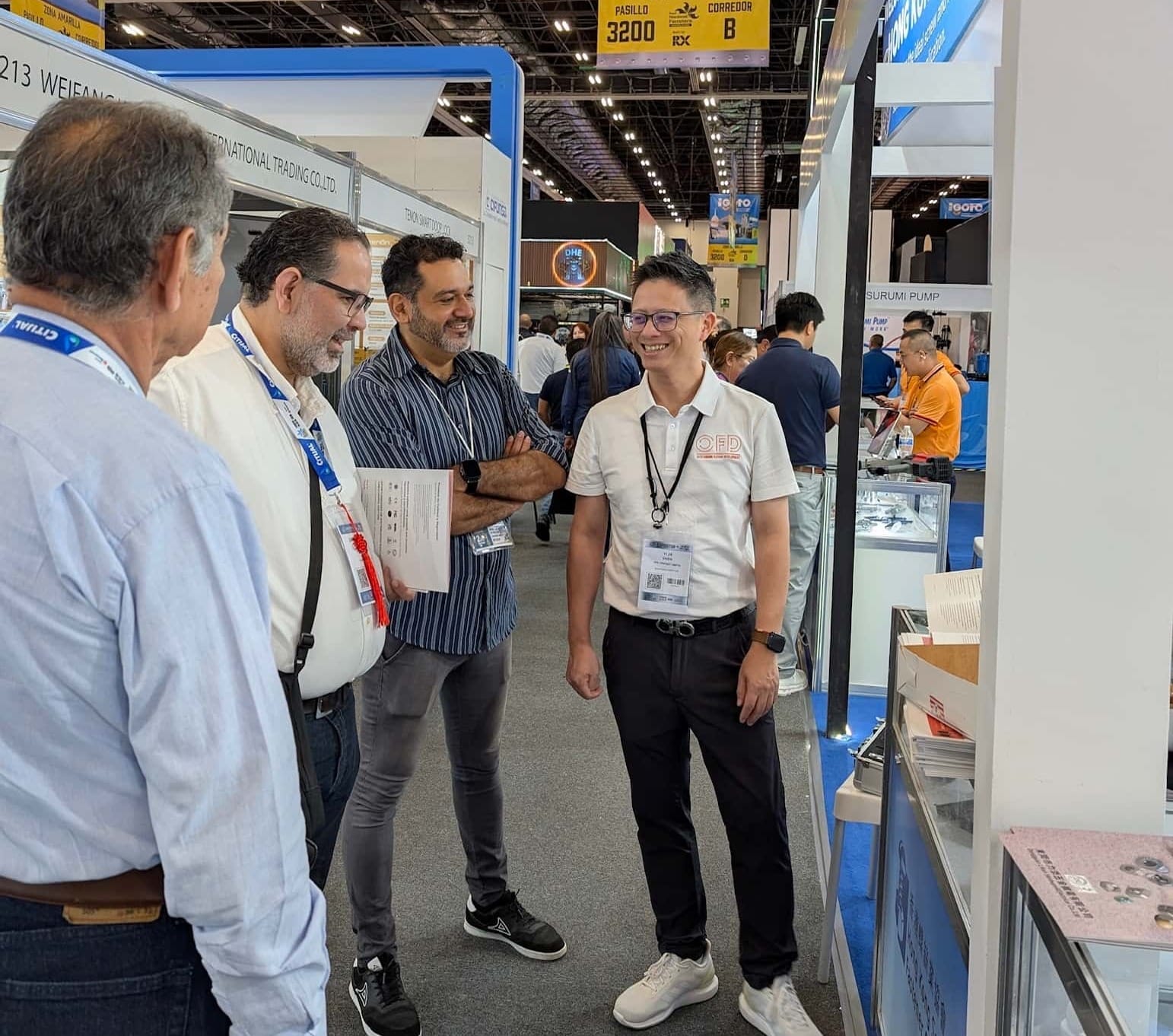

Interview with Charley Shen, Founder of OFD

In this interview, Charley breaks down in his own words where overseas founders go wrong, why quotes vary so much, and what execution actually takes when hardware gets real. Whether you’re prototyping an IoT device, preparing for mass production, or trying to avoid contractor traps, this is the kind of grounded insight most founders only learn after expensive mistakes.

Q1: What are the top mistakes overseas founders make when they come to Shenzhen?

Charley:

First, they start sourcing too early before specs are locked in. That leads to rework, delays, and scrap.

Second, they chase the lowest price without understanding what’s actually included. That often leads to quality or delivery issues later.

Third, they underestimate coordination costs, time zones, language, engineering assumptions. Misunderstandings pile up.

It keeps happening because Shenzhen feels fast and cheap on the surface, but hardware still needs structure and discipline.

Q2: Which stage actually kills the most hardware projects?

Charley:

Scaling and DFM.

Prototypes can be hacked together. But when you try to scale, things break: tooling, yield, consistency, cash flow.

Suddenly, the factory tells you your prototype isn’t manufacturable. You spend six months redoing everything, tooling, certifications, supply chain and miss your market window.

Q3: Why do quotes for the same product vary so much in Shenzhen?

Charley:

A few reasons. Even with the same BOM, suppliers may use different parts, original vs refurbished.

The size and tier of the CM matters too. You can’t expect Foxconn pricing to match a 100-person shop.

And if a client has worked with a supplier for years, they’ll get better support than a newcomer asking for a one-off quote.

Q4: If a founder only has 7 days in Shenzhen, how should they spend it?

Charley:

Here’s a no-BS schedule:

- Day 1–2: Deep dive into the design/spec with our engineers. Understand what kind of CM and parts are truly needed.

- Day 3–4: Visit 2–3 shortlisted CMs. Discuss real production risks with their management team.

- Day 5: Compare findings. Highlight the key issues and potential red flags.

- Day 6: Pick a top CM. Get detailed cost breakdowns and validate the supply chain.

- Day 7: Nail down contract terms not just with the CM, but the broader supply chain roles and responsibilities.

Q5: Why do some quotes look great on paper but end up costing founders more in the long run?

Charley:

Super low quotes usually shift risk to the customer. A factory might give you a cheap price to win the contract, then hit you with “material price hikes” or “unexpected engineering fees” later. Or they cut corners like skipping final QC to preserve their margin.

Q6: What’s the real difference between working with foreign-run firms and fully local Shenzhen teams?

Charley:

Foreign firms usually provide better documentation and smoother communication, but they’re slower and more expensive. Local teams are faster and cheaper but need tighter oversight.

Personally, I recommend founders work with a supply chain management firm like OFD. Without someone local keeping everyone accountable, “yes” can just mean “I heard you,” not “I will do it.”

Q7: How can founders avoid getting stuck in a chain of contractors and middlemen?

Charley:

Work with someone who can take you directly to the CM or component supplier, and ideally, support your mass production too. If they can help with engineering or second-stage development, you’re likely talking to the right partner.

Q8: After prototyping, what invisible issues tend to appear in real projects?

Charley:

We see issues like certification rework, component lifecycle mismatches, long lead-time risks, or logistics delays. Founders often underestimate how these affect cost, time, or consistency at scale.

Q9: What IP risks are real in Shenzhen yand what protection actually works?

Charley:

The real risk isn’t someone stealing your idea, it’s losing control of your firmware, tooling, or design know-how.

An NDA helps, but structure matters more. Fragment your supply chain: let Factory A do housings, Factory B the PCBA, and flash the final firmware yourself or in a secure place.

Q10: What were you doing before OFD and what made you start it in 2016?

Charley:

I worked in supply chain at Huawei and in HR at P&G, then joined a U.S.-headquartered component distributor, eventually becoming MD of its Hong Kong office.

I understood both the supply chain strengths here and the gaps foreign SMEs face. OFD was created to bridge that to help overseas founders bring prototypes to scalable production inside China’s hardware ecosystem.

Q11: OFD evolved from sourcing into full-stack integration. What was the hardest part of that transition?

Charley:

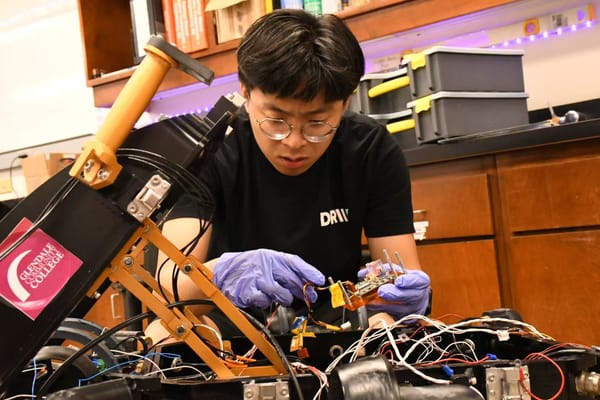

Shifting mindset. We moved from being pure supply chain consultants to managing full hardware-software co-development. That meant building (and partnering with) engineering teams who understand both layers deeply. R&D cycles got longer, and we had to be more patient and more structured.

Q12: What kinds of projects is OFD a good fit for and which ones do you turn down?

Charley:

We look for long-term partners. Most of our clients work with us for years.

We say no to one-time deals or founders who focus only on lowest price or keep changing roadmaps. That kind of short-term mindset leads to problems later.

Q13: How many projects do you handle per year and who are your typical clients?

Charley:

We handle more than 10 serious projects a year, not counting early-stage inquiries.

Most clients are from North America, Europe, and Latin America, across IoT, industrial, and smart device sectors.

Q14: OFD runs lean, but relies on a partner network. How do you decide what stays in-house?

Charley:

Project management and system architecture stay in-house, that’s our brain. Specialized tooling or assembly is outsourced.

We follow a “trust but verify” model: our engineers are on-site for every milestone run. Every shipment gets inspected. We act like the client’s local team here in China.

Q15: Can you give an example of a tough project, what broke, and how you handled it?

Charley:

One project was an edge gateway for a major hotel group.

We had to design a new architecture using a key IC with a long lifecycle, manage thermal performance, and ensure compatibility between hardware and firmware.

Then the IC hit sudden shortages due to demand from other industries. That broke our supply plan. We had to work fast with the customer to redesign and revalidate without delaying production.

Q16: CES made it clear that AI is moving into physical devices. From Shenzhen’s view, what changes for overseas founders?

Charley:

What gets harder is integration: power, thermals, performance, compliance, supply chain, all at once. A prototype might look great, but fail at scale if you don’t manage this upfront.

What gets easier is access. In Shenzhen, founders can build with proven AI chips, edge modules, and robotic components. What used to take years now takes months with the right partner.

The winners won’t be generic AI toys. They’ll be vertical, application-specific products: smart manufacturing, medical, industrial wearables, and robotics with real value.